About Chartered Accountancy

Chartered Accountancy is a rewarding career and there are excellent prospects for employment in audit firms as well as in local companies, multi-nationals, and local and foreign banks. The profession has stood the test of time, and career opportunities for Chartered Accountants are unfolding as corporate entities increasingly realize the importance of professional values, ethics and good governance. Becoming Chartered Accountant you will be top ranking executive in commerce and industry. Chartered Accountancy is making its own borders. You study here and practice the qualification across the world. To become a Chartered Accountant you need to be motivated, possess analytical skills, numerical ability, a keen sense of what is going on in the world of business and finance, and personal qualities such as reliability and discretion. You will be required to study business and corporate finance, economics, auditing, accounting, corporate laws, taxation laws, management and information systems.

Why Chartered Accountancy

- Chartered Accountants have a myriad of career options including working in high multinational corporations, advising governments, and supporting charities and businesses from every industry all over the world.

- Students with a Chartered Accountancy qualification are sought by employers all over the world.

- The starting salaries for chartered accountants are impressive and compare favorably with salaries for those starting out in law, general management and banking.

- The HEC equates CA qualification to a Master’s qualification in Commerce.

- Chartered Accountancy is a secure qualification because no matter the company size everyone needs a chartered accountant.

CAPS Philosophy

Our educational philosophy is simple – to provide the highest quality of lecturing and exceptional services to our students. At CAPS, your success is our top agenda!

About ICAP

The Institute of Chartered Accountants of Pakistan was established under the Chartered Accountants Ordinance, 1961 as a self-regulatory body and it operates under the CA Bye Laws 1983. ICAP is an examining body for the candidates aspiring to become Chartered Accountants. It regulates the accounting and auditing profession in Pakistan.ICAP is a member of International Federation of Accountants (IFAC), International Accounting Standards Board (IASB), Confederation of a Asian & Pacific Accountants (CAPA) and South Asian Federation of Accountants (SAFA).

PRC - Pre-Requisite Competencies

The competency for this level requires understanding and awareness of the subject matter and related concepts. The person will be expected to have the ability to understand the nature of basic concepts.

| Subject Code | Subject |

|---|---|

| PRC-1 | Business Writing and Comprehension Skills |

| PRC-2 | Quantitative Methods |

| PRC-3 | Principles of Economics |

| PRC-4 | Introduction to Accounting |

| PRC-5 | Introduction to Business |

CAF - Certificate in Accounting and Finance

The competency for this level requires good understanding and detailed evaluation of the subject matter and related concepts, along with the ability to apply concepts and skills in simple professional scenario. The person will be expected to have ability to provide reasonable justification and logical explanation to support their professional judgment and decision making.

Group - A

| Subject Code | Subject |

|---|---|

| CAF-1 | Financial Accounting and Reporting-I |

| CAF-2 | Tax Practices |

| CAF-3 | Cost and Management Accounting |

| CAF-4 | Business Law |

Group - B

| Subject Code | Subject |

|---|---|

| CAF-5 | Financial Accounting and Reporting-II |

| CAF-6 | Managerial and Financial Analysis |

| CAF-7 | Company Law |

| CAF-8 | Audit and Assurance |

CFAP - Certified Finance and Accounting Professional

The competency for this level requires an in-depth understanding of the subject matter and related concepts. The person will be expected to have the ability to critically examine and evaluate all concepts and available information to make firm professional judgments and make decisions. The examinations/ assessment at this stage will focus mostly on innovation and decision making with enhanced application and analytical skills

| Subject Code | Subject |

|---|---|

| CFAP-1 | Advanced Accounting and Financial Reporting |

| CFAP-2 | Advanced Corporate Laws and Practices |

| CFAP-3 | Strategy and Performance Measurement |

| CFAP-4 | Business Finance Decisions |

| CFAP-5 | Tax Planning and Practices |

| CFAP-6 | Audit, Assurance and Related Services |

MSA - Multi Subject Assessment

Final stage towards Chartered Accountant. The examinations/assessments at this stage will focus on integrated topics to ensure that candidates can solve and provide advice on complex business issues and problems.

| Subject Code | Subject |

|---|---|

| MSA-1 | Financial Reporting & Assurance - Professional Competence |

| MSA-2 | Management - Professional Competence |

Hands on Courses (HOC)

CAPS is an Approved HOC Provider of ICAP. ICAP introduced three hands-on courses to Improved presentation and personal effectiveness through critical evaluation of information,fundamental skills of IT and communication and enhanced skill set of data management, analysis and business intelligence to respond to the needs of emerging workplace.| HOC | Applicability |

|---|---|

| Presentation and Personal Effectiveness (PPE) | Any time before the commencement of training and during CAF |

| MS Office | Any time before the commencement of training and during CAF |

| Data Management and Analytics; or Fin-Tech | Any time before attempting MSA |

PPE

Professionals need to utilize their talents, strengths, energy, and time to manage their professions and businesses well on daily basis. On their road to success, they encounter challenges not only to meet their objectives but also to maintain their work-life balance. Though everyone aspires to reach their potential yet many often also struggle for a lack of skills, motivation, and confidence. Yet many others have goals and priorities in life which are different from others which further impacts their efficacy at work. This course seeks to enhance students’ inner potential and build personal effectiveness in while working and interacting in profession and business situations.

MS OFFICE

Microsoft Office mastery is key for accounting professionals. This course intends to enable students to apply fundamental skills of IT and communication (computer fundamentals and MS Word, MS Excel, MS Power Point).

DATA MANAGEMENT AND ANALYTICS/FIN-TECH

The course is intended for professionals using data for finance, audit and other business decisions. It is aimed to provide the participants with skill set, to understand and create financial models using software & tools to have better insights for improved decision making in timely and efficient manner. It emphasizes on financial modeling, forecasting, technical software and system language that facilitate prediction of potential results based on patterns.

ICAP Education Scheme

| Education Scheme (PRC|QAT) |

| Education Scheme 2021 (CAF|CFAP|MSA) |

| FAQs on Education Scheme 2021 |

Examination Schedule

| Stage | Frequency | Months |

|---|---|---|

| QAT | Quarterly | March | June | September | December |

| PRC | Monthly | Every Month |

| CAF | Semi-annually (Spring and Autumn) | March | September |

| CFAP & MSA | Semi-annually (Summer and Winter) | June | December |

| HOC on Data Analytics and FinTech | Semi-annually (Spring and Autumn) | March | September |

Papers To Attempt

| Stages | Eligibility | Maximum number of paper permitted in one session | Minimum training period to be served |

|---|---|---|---|

| PRC | After registration / QAT | No limit | None |

| CAF | After passing or obtaining exemption from PRC | 4 papers | None |

| CFAP | After passing or obtaining exemption from CAF | No limit | 1 year |

| MSA-1 | After passing the following CFAP papers: | N/A | 1 year |

| MSA-2 | After passing the following CFAP papers: | N/A | 1.5 year |

Maximum number of Attempts

| Stages | Maximum permitted attempts | Additional attempts |

|---|---|---|

| PRC | 12 Months | 3 Months (if 1 paper remains) |

| CAF | Six attempts per paper | Two more attempts after using all permitted attempts per paper for those who have maximum two papers left. |

| CFAP | 10 years | if 2 minimum papers are passed. |

| MSA | Unlimited | Not applicable |

Exemptions To New Students

The exemptions on the basis of academic qualification are available to the following categories:

| Stages | Available Exemptions | ||||

| 4 year (SDAI*) |

4 year (RDAI**) |

Other 4 years degree | HSSC | A-levels | |

| PRC | All papers of PRC | All papers of PRC

Minimum 60% marks in aggregate 60% marks or equivalent grades in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject |

All papers of PRC

Minimum 60% marks in aggregate 75% marks or equivalent grades in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject |

All papers of PRC

Minimum 70% marks in aggregate 75% marks or equivalent grades in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject |

All papers of PRC

Minimum two B grades B grade in relevent subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject |

| CAF | All CAF papers

Minimum 60% marks or equivalent grades in relevant subjects Syllabus matches at least 70% with that of the prescribed syllabus of relevant subjects |

CAF (1,4,6 & 7)

Minimum 60% marks in 75% marks or equivalent grades in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject. |

CAF 1 to CAF 8 (Depending upon the degree awarded institute)

Minimum two B grades B Grade in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject. |

||

| * SDAI: Specified Degree Awarding Institutes – Lahore University of Management Sciences (LUMS) Lahore. – Institute of Business Administration (IBA) Karachi. |

* RDAI: Relevant Degree Awarding Institutes – Institute of Business Management (IoBM) Karachi. – National University of Sciences and Technology (NUST) Islamabad. – University of Central Punjab (UCP) Lahore. – University of Lahore (UOL) Lahore. – University of Management and Technology (UMT) Lahore. |

||||

Exemptions for other Professional Qualification

| Stages and Papers | ACCA | CIMA | ICMAP | PIPFA | |

| Pre Requisite Competencies (PRC) | |||||

| PRC-1 | Business Writing & Comprehension skills | Y | Y | Y | Y |

| PRC-2 | Quantitaive Methods | Y | Y | Y | Y |

| PRC-3 | Principles of Economics | Y | Y | Y | Y |

| PRC-4 | Introduction to Accounting | Y | Y | Y | Y |

| PRC-5 | Introduction to Business | Y | Y | Y | Y |

| Certificate in Accounting and Finance (CAF) | |||||

| CAF-1 | Financial Accounting and Reporting – I | Y | Y | Y | |

| CAF-2 | Tax Practices | Y | |||

| CAF-3 | Cost and Management Accounting | Y | Y | Y | |

| CAF-4 | Business Law | Y | Y | Y | |

| CAF-5 | Financial Accounting and Reporting – II | Y | Y | Y | |

| CAF-6 | Managerial & Financial Analysis | Y | Y | ||

| CAF-7 | Company Law | Y | Y | Y | |

| CAF-8 | Audit and Assurance | Y | Y | ||

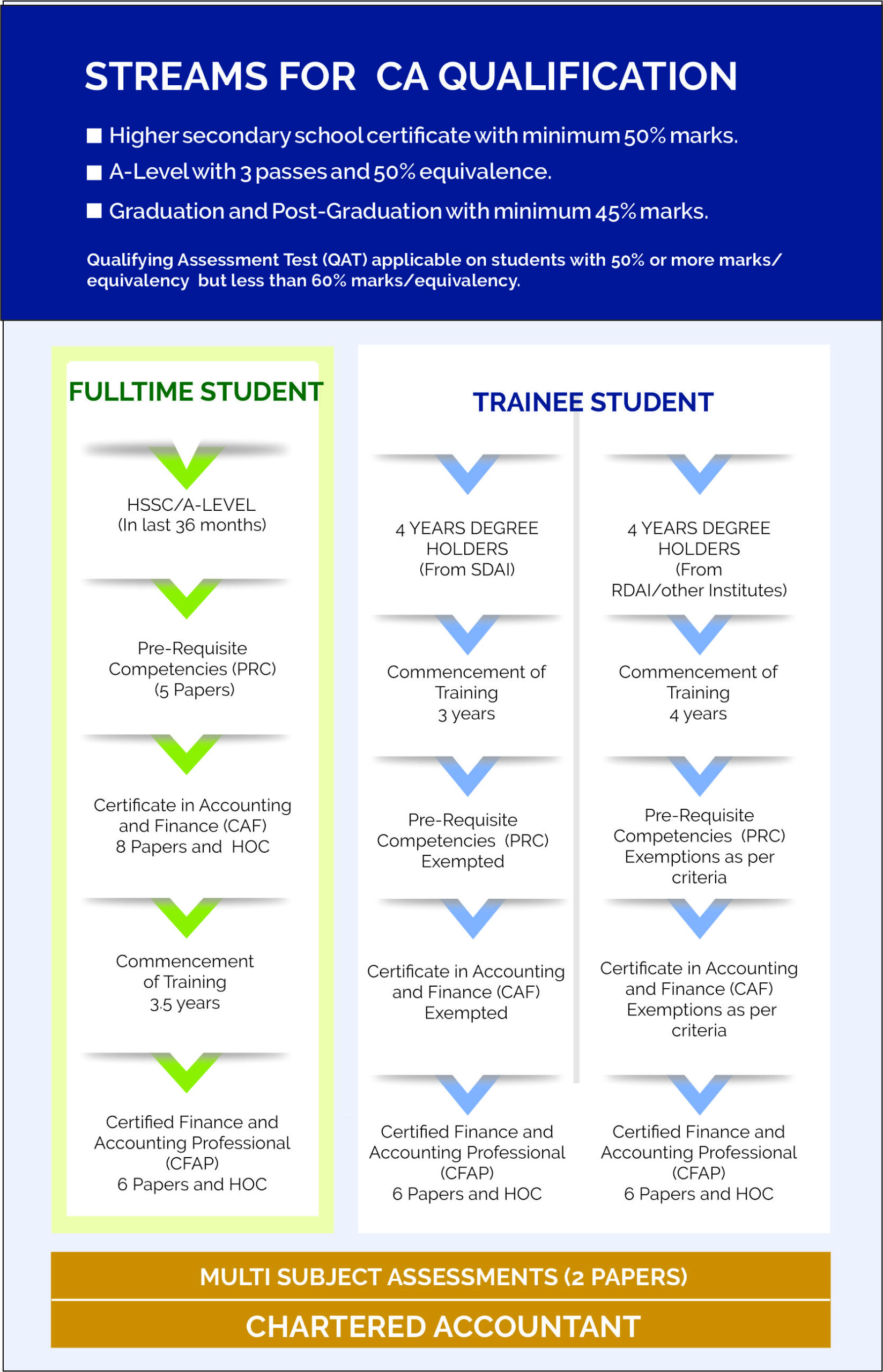

Training and Education

On successful completion of CAF, it is mandatory for the student to join an authorized training organization of the Institute for a prescribed period.Training includes specific learning hours for each field of specialization through practical experience. Training includes specific learning hours for each field of specialization through practical experience.

Period of Training

Presently, the Institute only authorizes the practicing firms of chartered accountants to offer practical training. The period of training varies with the academic education background of a trainee.

The following table provides the information about the length of the training.

| Sr. | Qualification on the Commencement of Training | Period of Training |

| i | Candidates who have passed or obtained exemption from CAF | 3.5 years |

| ii | Four year Graduate/Post Graduate from universities approved by the Education and Training Committee of the Institute | 3 years |

| iii | Graduates/post graduates other than those mentioned at (ii) above | 4 years |

| * Currently, four year graduates from SDAIs are eligible for three year training mentioned in the above table. | ||

ICAP Contacts

| Head Office |

|---|

| Chartered Accountants Avenue, Clifton, Karachi – 75600

UAN: (92-21) 111-000-422 |

| Regional Office |

| 155-156, West Wood Colony, Thokar Niaz Baig, Raiwind Road, Lahore

UAN:(92-42) 111-000-422 |